Receipt Imaging attaches an electronic copy of receipts to a P-card statement.

When the gift certificate is redeemed, a receipt for the dollar amount of the gift certificate is not issued. When a gift certificate is purchased, the description of the service is “Gift Certificate” and the dollar amount paid is listed on the receipt. The receipt is still issued in the name of the payer. In the case of a third party paying for the Massage Therapy treatment on behalf of the client, the description of service must read “Massage Therapy Treatment for _” and the name of the recipient of the Massage Therapy treatment is inserted.

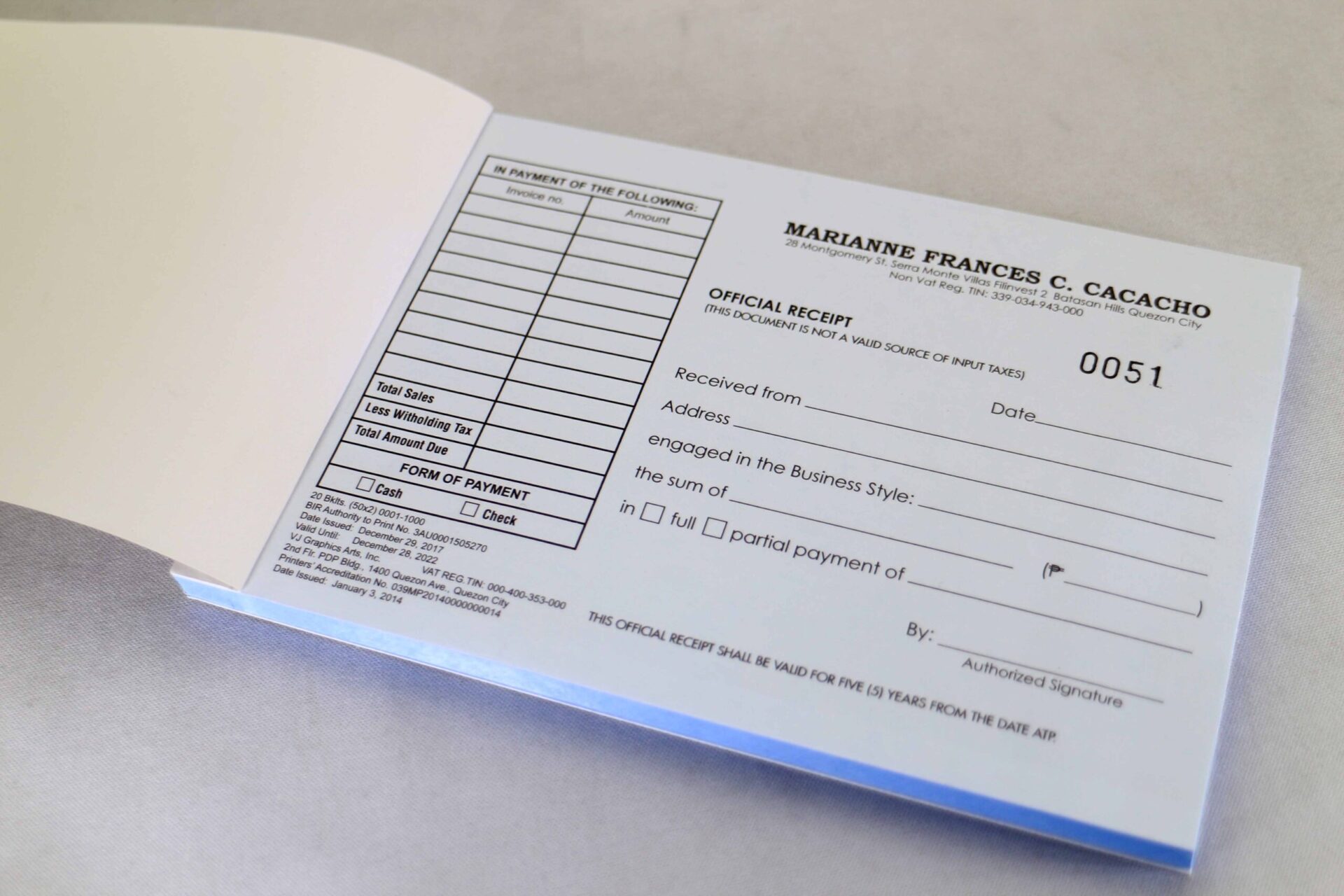

#Receipts registration#

The description of service must read “Massage Therapy Treatment.”įor products and services that are outside of the Massage Therapy scope of practice, the receipt must not include the member’s registration number or MT designation, the description cannot read “Massage Therapy treatment” and it must indicate the product or service provided. If the Massage Therapist collects HST, their HST number must also appear on the receipt. When issuing a receipt for a Massage Therapy appointment the receipt must have the date of the appointment, the name of the client, the amount of the transaction and the name, signature and registration number of the Massage Therapist. Receipts issued for Massage Therapy treatment also require that the name of the therapist is printed or stamped on the receipt along with the Massage Therapist’s registration number and signature. The date of the financial transaction, the description of the service, duration of treatment and the name of the payer must appear on the receipt. Receipts provided for Massage Therapy services may only be issued for those services that fall within the scope of practice and must be signed by the Massage Therapist who performed the service.

Receipts are a record of a financial transaction and are to be provided at the time the service or product is purchased. The information on the receipt may be used by insurance carriers and/or Canada Revenue Agency for taxation purposes and must be an accurate reflection of the service or product provided, the payee, the provider and the fee received.

This policy provides guidance to members regarding what information must be placed on the receipt when they are issued. The financial record must include a copy or record of the receipt issued for payment of the services provided. 10, requires that a financial record be kept for each client.

Ontario Regulation 544/94 as amended to 474/99 s.

0 kommentar(er)

0 kommentar(er)